NPS Scheme Benefit

National Pension Scheme (NPS) India is a voluntary and long-lasting investment prepared for retirement under the view of the Pension Fund Regulatory and Development Authority (PFRDA) and the Central Government.

We have covered the complying in this short article. Latest Update

The CBDT informs Form 12BBA, a declaration form, to be submitted by the qualified senior residents to the specified banks to take relief from filing the ITR.

In Budget 2021, it has been suggested to exclude elderly people from filing income tax returns if pension income, as well as interest income, are their only yearly earnings resources.

Section 194P has actually been freshly inserted to apply that financial institutions subtract tax on senior residents of greater than 75 years of age who have a pension and also interest earnings from the financial institution.

What is National Pension Plan (NPS)?

The National Pension Scheme also called National Pension System is open to all workers from the public market, private sector, and also the unorganized field besides those who operate in the Armed Forces.

In the NPS scheme, the members can make a minimal contribution of Rs.6,000 in a fiscal year, which can be paid as a round figure or as monthly instalments of a minimum of Rs.500.

In the NPS plan, the contribution of the members is invested right into market-linked tools like debt and equity as well as the returns depend upon the efficiency of these investments.

The present interest rate of NPS is 8-10% on the payment made.

Any kind of Indian resident from the age group of 18 years to 60 years can open up the National Pension Plan account.

Regulated by PFRDA, the National Pension Scheme grows at the age of 60 years and also can be extended up to 70 years.

The national pension plan scheme allows the members to make partial withdrawals of approximately 25% of the payment after 3 years of opening the account in certain circumstances like :-

- purchasing a residence,

- sponsoring a child's education and learning, or

- for the treatment of any kind of crucial illnesses.

Fees and also Applicable Charges of the NPS Scheme

Category | Central Record Keeping Agency (CRA) | |

Charge head | Permanent Retirement Account (PRA) Opening charges | |

Service Charges* | Private / Government | |

CRA charges if the individual opts for a Physical PRAN card | NCRA - Rs. 40 | KCRA - Rs. 39.36 |

CRA charges if the individual opts for an ePRAN card (Physical welcome kit) | NCRA - Rs. 35 | KCRA - Rs. 39.36 |

Welcome kit via email | NCRA - Rs. 18 | KCRA - Rs. 4 |

Maintenance cost of PRA (Annually) | NCRA - Rs. 69 | KCRA: Rs. 57.63 |

Transaction charges | NCRA - Rs. 3.75 | KCRA - Rs. 3.36 |

Keep in mind: The reduction accountability will certainly get on the current rate framework and also leaves out appropriate taxes Rates will certainly apply post-release of the capabilities by CRAs to record the choice of NPS members to have physical or ePRAN cards.

Category | Point of Presence (POP) | |

Charge head | Permanent Retirement Account (PRA) Opening charges | |

Service Charges | Private | Govt. |

Initial contribution during registration | Rs. 200 | NA |

additional transactions | 0.25% of the contribution Min. Rs. 20 Max. Rs. 25000 Non-Financial Rs. 20 | NA |

Persistency Less than 6 months and contribution of Rs 1000 | Rs. 50 per annum | NA |

eNPS Contribution | 0.10% of contribution, Min. Rs.10 Max. Rs.10000 | NA |

Payment Gateway Service Fee (Applicable for transactions made on the eNPS system).

Trustee Bank | - | NIL | |||

Custodian | Asset Servicing charges | 0.0032% per annum for Electro-nic segment & Physical segment | |||

NPS Trust | Reimburse-ment of Expenses | 0.005% per annum | |||

Payment Gateway Service Charge (Applicable for transa-ctions made on eNPS platform) | Mode of Payment | Method for quotation rate per transa-ction | Pay-ment Gate-way Service Provider | ||

India Ideas. com Limited (Bill desk) | |||||

Credit cards | Percen-tage (%) of transa-ction value | 0.75% | |||

Eligibility Criteria of NPS Plan.

Who should get the NPS?

The NPS is an excellent plan for anybody who wishes to plan for their retirement early and has a low-risk appetite.

A normal pension (earnings) in your retirement years will certainly no question be a boon, particularly for those individuals who retire from private-sector jobs.

A methodical financial investment similar to this can make an enormous difference to your life post-retirement.

As a matter of fact, Salaried people that wish to maximize the 80C reductions can additionally consider this scheme.

Features & Benefits of NPS.

1. Returns/Interest.

A portion of the NPS goes to equities (this might not provide guaranteed returns).

It offers returns that are a lot higher than other traditional tax-saving financial investments like the PPF.

This scheme has held for over a year, and so far has provided 8% to 10% annualised returns.

In NPS, you are additionally permitted the alternative to transform your fund supervisor if you are not satisfied with the efficiency of the fund.

2. Tax efficiency- NPS tax benefit.

The National Pension System allows tax obligation exemption on the contribution made towards the scheme as much as the highest permissible amount under Section 80C of the Income Tax Act, which is Rs. 1.5 lakh.

Furthermore, in the NPS plan, the contribution made by the employer and also the staff member are both relevant for the tax exemption.

80CCD(1)- This is a contribution to the U/S 80elf fund.

The maximum deduction of up to 10% of the salary can be claimed for tax obligation exemption under this section. For the taxpayers who are self-employed, this limitation is 20% of the gross income.

80CCD(2)- This section covers the contribution made by employers toward the NPS scheme.

This advantage does not apply to self-employed taxpayers.

The optimum amount entitled to the tax exemption is the most affordable of the:

- Actual NPS payment by employer

- 10% of Basic + Dearness Allowance

- Gross total earnings.

You can claim any added self-payment (as much as Rs. 50,000) under section 80CCD( 1B) as National Pension Scheme (NPS) tax benefit.

3. Risk Assessment.

Presently, there is a cap in the range of 75% to 50% on equity exposure for the National Pension Plan. For civil servants, this cap is 50%.

In the variation suggested, the equity portion will certainly lower by 2.5% yearly starting from the year in which the investor transforms 50 years old.

Nevertheless, for a financier aged 60 years and also above, the cap is fixed at 50%.

This stabilizes the risk-return formula in the interest of financiers, which implies the corpus is rather risk-free from the equity market volatility.

The gaining potential of NPS is greater as contrasted to other fixed-income schemes.

4. Withdrawal Rules After 60.

As opposed to the typical idea, you can not withdraw the whole entirety of the NPS scheme after your retired life.

You are compulsorily required to keep aside at least 40% of the corpus to receive a regular pension from a PFRDA-registered insurance company.

The continuing to be 60% is tax-free currently. The current upgrade from the federal government states that the whole NPS withdrawal corpus is exempt from tax.

5. Early Withdrawal and Exit guidelines.

As a pension plan, it is important for you to proceed to put in till the age of 60.

If you have been investing for at the very least 3 years, you may withdraw up to 25% for specific functions.

These consist of kids' weddings or greater research studies, building/buying a residence or medical treatment of self/family, to name a few. You can make a withdrawal up to 3 times (with a gap of 5 years) in the entire tenure.

These restrictions are just imposed on tier I accounts and also out tier II accounts. Please scroll down for even more details on them.

6. Equity Allocation Rules.

The NPS purchases different plans, and the Scheme E of the NPS invests in equity. You can allocate an optimum of 50% of your investment to equities.

There are 2 options to buy-- vehicle option or active choice.

The vehicle choice determines the threat account of your financial investments as per your age.

The older you are, the much more secure and much less risky your investments.

The energetic option allows you to choose the scheme and also divide your investments.

7. Option to alter the Scheme or Fund Manager.

With NPS, you have the arrangement to change the pension plan or the fund manager if you are not satisfied with their performance.

This option is offered for both tiers I and also II accounts.

8. It is Voluntary.

In the NPS plan, the subscriber can add anytime throughout a fiscal year as well as can likewise alter the amount he/she wishes to invest annually.

9. It is Simple.

The members can open up the NPS account by checking out the internet site of eNPS( https://enps.nsld.com/eNPS/) or at any one of the points of Presence (POP).

10. Offers Flexibility.

National Pension Scheme provides flexibility as customers can pick their alternative investment and pension fund and see their investment expand.

How to open an NPS account.

PFRDA manages the procedures of the NPS, as well as they, provide both an online and offline means to open this account.

Offline Process.

To open up an NPS account offline or by hand, you will certainly have to discover a PoP-- Point of Presence, (it could be a bank as well).

Accumulate a subscriber kind from your closest PoP and send it along with the KYC documents.

Neglect if you are already KYC-compliant with that bank.

As soon as you make the initial investment (not less than Rs.500 or Rs.250 regular monthly or the PRAN, or Permanent Retirement Account Number, will be mailed to you by the PoP once you've made the yearly Rs. 1,000 minimum contribution requirement.

This number as well as the password in your sealed welcome kit will certainly help you run your account. There is a single enrollment fee of Rs.125 for this procedure.

Online Process.

It is currently feasible to open up an NPS account in less than half an hour.

Opening up an account online (enps.nsdl.com) is very easy, if you connect your account to your PAN, Aadhaar as well as mobile number.

You can validate the enrollment using the OTP sent out to your mobile.

This will create a PRAN (Permanent Retirement Account Number), which you can utilize for NPS login.

Types of NPS Account.

The two main account types under the NPS are tier I as well as tier II.

The former is the default account while the last is a voluntary addition. The table listed below explains both accounts' entered information.

Particulars | NPS Tier-I Account | NPS Tier-II Account |

Status | Default | Voluntary |

Withdrawals | Not permitted | Permitted |

Tax exemption | Up to Rs 2 lakh p.a.(Under 80C and 80CCD) | 1.5 lakh for government employees Other employees-None |

Minimum NPS contribution | Rs 500 or Rs 500 or Rs 1,000 p.a. | Rs 250 |

Maximum NPS contribution | No limit | No limit |

The Tier-I account is obligatory for every person that opts for the NPS scheme.

The Central Government staff members have to contribute 10% of their basic income. For every person else, the NPS is a voluntary investment option.

Comparing the NPS scheme with various other Tax Saving Instruments.

PPF and tax-free Fixed Deposits (FD). Here is how they compare to the National Pension Scheme.

Investment | Interest | Lock-in period | Risk Profile |

NPS | 8% to 10%* | Till retirement | Market-related risks |

ELSS | 12% to 15%* | 3 years | Market-related risks |

PPF | 8.1%** | 15 years | Risk-free |

FD | 7% to 9%** | 5 years | Risk-free |

* Expected ** Guaranteed

The NPS can earn greater returns than the PPF or FDs, however, it is not as tax-efficient upon maturation.

You can withdraw up to 60% of your gathered amount from your NPS account.

Out of this, 20% is taxable. Taxability on NPS withdrawal goes through change.

Comparison : NPS with ELSS.

The advantage of the National Pension Scheme is that it has equity appropriation.

The equity allotment is still not as much as tax-saving common funds.

Equity-Linked Savings Plans spend primarily on equities as well as can generate greater returns than the NPS.

The lock-in period of tax-saving mutual funds is also minimal to NPS-- just 3 years compared to NPS.

Additionally, if you are a hostile risk-seeker, equity exposure by NPS will not suffice in the long run.

Given that ELSS can meet that requirement, it offers financiers with more risk appetite much better.

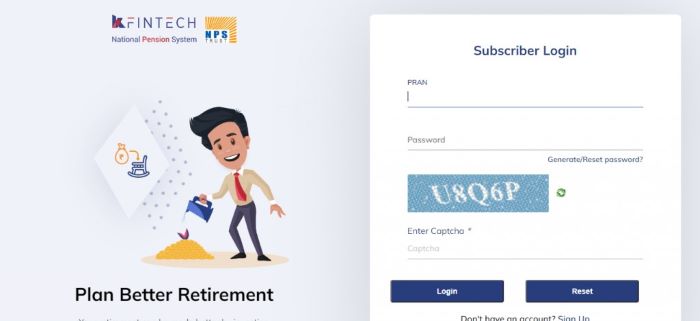

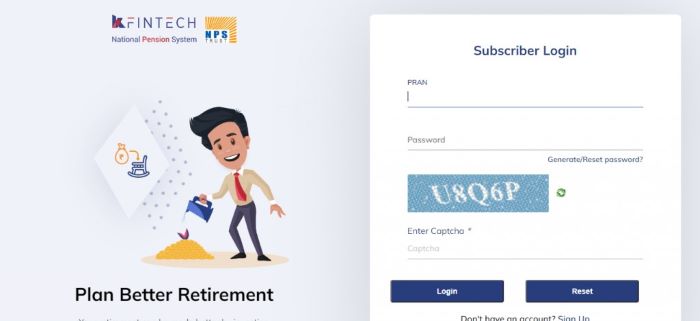

How to log in to your NPS account for the very first time?

- Step 1: In order to log into your NPS account, you need to have a 12-digit Permanent Retirement Account Number (PRAN).

- Step 2: Submit the essential paperwork on the NSDL website or at the Point of Presence (POP) provider to get PRAN.

- Step 2: Visit the eNPS login web page https://enps.kfintech.com/login/login/.

- Step 3: If you are a new to website and do not bear in mind the password, click on the 'Generate/Reset password' option at the bottom of the web page.

- Step 4: Enter PRAN, day of birth, and also captcha to create OTP and click the 'Submit' key.

- Step 5: An OTP will certainly be sent out to your registered mobile number. Once you enter this OTP on the display, your password will be confirmed.

- Step 6: Now go back to the login display as well as enter your PRAN, password, as well as a captcha. Click the 'Login' key.

- Step 7: You will certainly be redirected to the web page of your account.

What is the customer ID for NPS login?

Your Permanent Retirement Account Number (PRAN) that is provided on enrollment for the NPS account will certainly be your user ID to visit the eNPS-NSDL internet site.

A Word from Money a to z

National Pension Scheme (NPS) India is a volunteer as well as long-lasting investment strategy for retirement under the purview of the Pension Fund Regulatory and also Development Authority (PFRDA) and also the Central Government.

Any kind of Indian citizen from the age team of 18 years to 60 years can open up the National Pension Scheme account.

The national pension plan scheme permits the customers to make partial withdrawals of up to 25% of the contribution after 3 years of opening the account.

It can be in some circumstances like

- investing in a residence,

- funding a kid's education and learning, or

- for the treatment of any kind of critical health problems.

The NPS spends on various schemes, and the Plan E of the NPS spends on equity. Everyone who joins the NPS scheme has to open a Tier-I account.

Think about spending in the NPS plan if the benefits elaborated above suit your danger account as well as your financial investment goal.

If you are open to much more equity exposure, numerous common funds are catering to investors from diverse histories readily available.

If you assume investigating, shortlisting as well as settling is an excessive job, moneyatoz has currently looked after them.

We have actually handpicked the best-performing funds from the top fund residences for you. It is never ever far too late to invest.